As readers know, investing with an eye to impact on the environment is one of the hot topics in wealth management and financial services more broadly. The issues remain controversial and there is continued need for hard data on how to measure investments that have an environmental component. Here, Morgan Gillespy, who is director of Forests at CDP, a disclosure impact group, addresses some of the issues. The editors are pleased to share these insights and invites readers to respond. Email tom.burroughes@wealthbriefing.com

The viability of a wide range of commodities from paper to palm oil, cattle to cocoa, is under growing threat from rapid rates of deforestation. Far from being a concern only for conservationists, deforestation is on track to have wide-ranging economic consequences, for sectors from food to consumer goods.

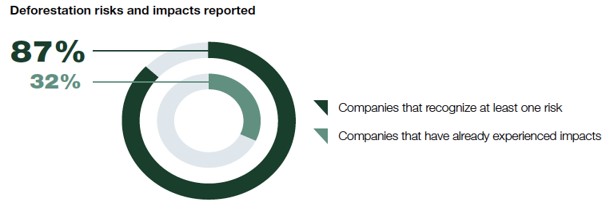

Recent research analysing 201 major companies, including the likes of McDonald’s and Unilever, showed that $941 billion of turnover in publicly listed companies was dependent on commodities linked to deforestation, a 3 per cent increase on last year. A full 87 per cent of companies , including multinational giants like Colgate Palmolive and Dunkin’ Donuts, identify risks to their business from deforestation.

Thus, there are two things that wealth managers should ensure they are aware of. Firstly, the industries that are likely to be the most affected, and secondly, what corporate best practice on deforestation management looks like.

Identifying the risks – which industries are likely to be the most affected?

Whilst deforestation has the potential to disrupt supply chains across many industries, the three commodities most exposed to deforestation are cattle, soy and palm oil – all central to the viability of major food producers and retailers. Palm oil, for example, is found in around half of all packaged goods in supermarkets globally. Thus, wealth managers should be particularly concerned about whether food companies in their clients’ portfolios are monitoring and managing whether their products are causing deforestation.

Last year for example, companies such as Kellogg’s, Mars and Nestle were among the household names that had to cancel their contracts with Malaysia’s IOI Corporation – when the Asian conglomerate temporarily lost is sustainable palm oil certification. This wiped 18 per cent, or over $1.3 billion off the market value of IOI Corporation.

However, it is not just the food sector that is exposed to deforestation risks. In 2017 HSBC found itself the subject of a sustained campaign by Greenpeace over the bank’s financing of palm oil companies. In response, it toughened its agricultural commodities policy, including adopting a “No Deforestation, no Peat and no Exploitation” commitment, and extending it to include refiners and traders.

Major companies such as Unilever, Procter & Gamble, and Tesco have also made NDPE commitments in recent years. As a result of the growth of NDPE policies, new research has found that almost a third of the land-bank held by Indonesian palm oil producers cannot viably be developed – raising the risk of assets becoming stranded.

Figure 1:

Building a resilient portfolio - what does corporate best practice on deforestation management looks like?

An analysis of 201 major companies, undertaken by non-profit global environmental disclosure platform CDP, identified six stocks that made an “A” List for tackling deforestation. They were Brambles, L’Oréal, SCA, Tetra Pak, Unilever, and UPM-Kymmene. Whilst data like this can’t be used to conclusively say if environmental performance leads to financial performance, results are encouraging. Companies on CDP’s Climate A List have outperformed the market by 6 per cent over four years, according to STOXX.

CDP’s analysis also referenced Firmenich SA, a Swiss perfume company that has identified potential revenue growth of more than 5 per cent from its “sustainable product” branding.

But while opportunities are there for the taking, wealth managers can only identify companies which are successfully and profitably tackling deforestation if those companies are transparent about their actions. The same goes for the associated risks, and with inaction on unsustainable production of forest-risk commodities leading to potentially millions of dollars of investments becoming "stranded assets”, investors are increasingly concerned about the impact deforestation could have on their portfolios.

However, despite this demand, less than a quarter of the 838 companies approached by CDP on behalf of investors reported on their forests practice. This leaves wealth managers in the dark about the deforestation risks they may face in the remaining 77 per cent of companies – a sizable majority.

From risks to returns

From disrupted supply chains to stranded assets, the risks posed by deforestation are severe and material and few industries will be immune. However, by identifying the companies that disclose their activity, manage the risks and cater to growing consumer demand for sustainable products, wealth managers can unlock value and deliver returns that outperform.

Footnotes:

https://www.environmentalleader.com/2017/11/questionable-deforestation-practices-lead-losses-examples-ceres/?amp=1

The Tropical Forest Alliance 2020 estimates that anticipated investments worth tens of billions of dollars over the next 10 years are at risk of stranding, if strategic and financial institutions invest in the expansion of business-as-usual production. If all production areas that were illegally deforested in the past are included, that figure rises to the hundreds of billions.